If you're even slightly interested in the world of finance, you'll know that ESG or "environmental, social and governance(-themed investing)" is kind of huge. Some hyperbolic estimates posit that a quarter of all assets under management are tagged this way.

If you're a financial journalist you'll also know that criticising ESG is very hot right now. Last Thursday's edition of FT Moral Money - a publication that presumably owes much of its readership and advertising revenue to the ESG boom - had a rather brutal take:

There's been a boom in the ESG subset of financial services for a few years; numbers from Bloomberg Intelligence & the Global Sustainable Investment Alliance suggest that 2016-2018 was when it really started to take off. That level of growth seems to be slowing in many categories, so there will be many "what went wrong" takes over the next few months that will include everything from the Ukraine invasion to inflation to whistleblowers like Tariq Fancy.

The IFRS' new International Sustainability Standards Board, which will codify how the accounting profession treats ESG-type matters, is an example of how acute the disagreements have become.

The inside disagreements and the public criticisms all come down to the same thing: what's the purpose of ESG (and responsible, sustainable, etc investing)? Are these financial products meant to do good, or to improve returns?

I suspect climate change is the thing that's responsible for ESG being so big, but also for also driving a lot of this discord right now.

I was spurred to write about this a few weeks back by a thread from someone who'd listened to MSCI's earnings call and was relaying what the CEO had said about ESG:

This thread is good!

— Kate Mackenzie (@kmac) February 15, 2022

The takeaway is that MSCI's chief exec said the quiet part out loud about ESG.

I don't quite think that.

But I do think it reflects something that's about the ESG & broader financial services sector that's probably just as bad... https://t.co/D0Jvr9KQFf

What happened was, MSCI was the subject of a long reported story in Bloomberg Businessweek. The story explored the contradiction in MSCI's marketing its ESG indexes and company ratings as broadly being a force for good, whereas in fact it's really about analysing ESG-related financial risks. An example is given that the "water stress" score assigned to a company doesn't reflect if the company creates water stress for people or the environment; rather it reflects if the company itself is vulnerable to water stress that could affect it financially.

A cool thing about this story is that it exposes one of those weird functions within the macro-financial landscape that we don't often think about or even know about. Indexes developed by the likes of MSCI are subscribed to by the likes of Blackrock, and so the exact weighting allocated to a company by MSCI has a very material effect on how much that company's shares are bought.

Anyway, in response to questioning about this at a subsequent earnings call, MSCI's ESG indexes chief executive basically said hey, it was never meant to be about making the world better; we just sell information, we don't tell people what to do with it.

I browed around MSCI's ESG web pages and to be fair, the initial landing page for their ESG ratings service says it "is designed to measure a company’s resilience to long-term industry material environmental, social and governance (ESG) risks". In other words, not about helping the world, but about measuring the company's impact.

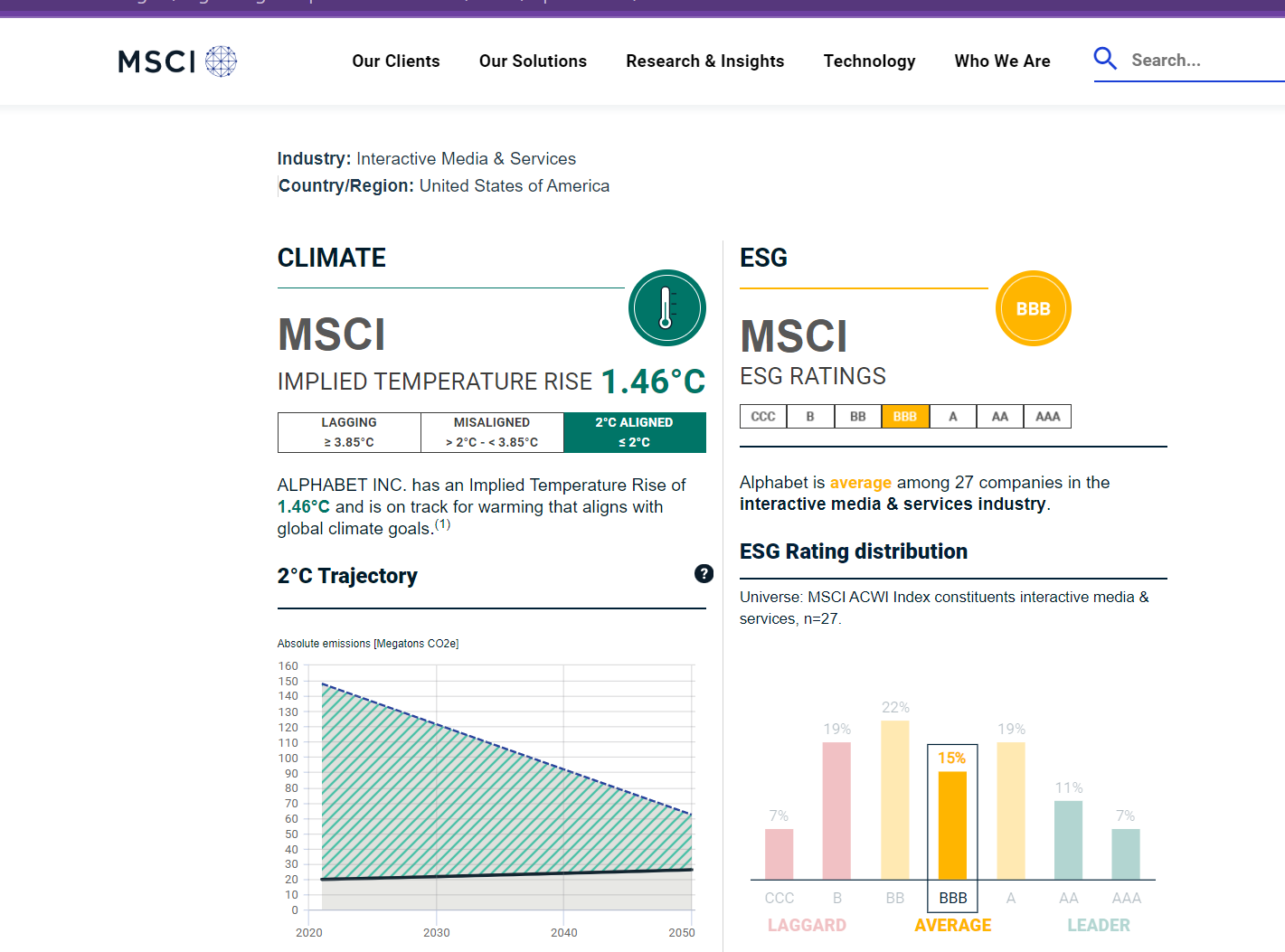

That clear distinction gets blurry fast. If you scroll down and click into the first box under "ESG rating and transparency tools" you'll be taken to the "ESG ratings and climate search tool". You type in a company ticker or name, and get two sets of results, side by side:

Here we can already see a mingling of the distinct objectives of financial management and "impact on the planet".

On the left is the company's "implied temperature rise" - an assessment of its alignment with Paris climate goals (which they incorrectly define as a warming limit of 2C). On the right is the company's ESG rating by MSCI, an assessment of its exposure to ESG-related (financial) risks.

The one on the right is absolutely financial in nature.

The one on the left could go either way "implied temperature rise" tells you if the company is reducing its emissions in line with a particular temperature outcome. So that sounds very much like "doing good" for the world. Yet it could also be read as managing a financial risk. That is, the "transition risk" arising from a shift away from emissions, which could lead an unprepared company to lose market share or profits.

The category of "climate" has a big, Venn diagram kind of overlap with ESG. A lot of climate is outside ESG because it is risk-based. But often climate risk is addressed within ESG services and strategies because it is an environmental risk. And if you care about the environment at all, then you for sure want to preserve a stable climate.

But climate-themed investing has a unique way of blurring the lines between "financial materiality" and "doing good/impact/alignment".

We tend to see "doing good" investment as being somewhat at odds with traditional investment goals of maximising risk-adjusted financial returns to the beneficiary. That's not always the case. The time horizon over which one is investing, and how one defines risk, and even how one defines the beneficiary's best interests, can all lead to an overlap or convergence between these purposes. I alluded to this in the thread about the history of thinking about fiduciary duty, but a touchstone of this was a 2005 report by legal firm Freshfields Bruckhaus Deringer for UNEP-FI which concluded that fiduciary obligations as they apply across jurisdictions are essentially aligned with ESG objectives. (Interestingly, Freshfields' definition of ESG includes that they are the focus of public concern, are qualitative and not quantitative, that they may involve externalities, and that they may be subject to a tightening regulatory environment.)

That point about "qualitative not quantitative" is telling.

The real breakthrough moment for climate change was when the concept of the carbon budget was taken from the academic literature translated in 2011 by the Carbon Tracker folk into an estimate of the fossil fuel reserves that are "unburnable" if we are to retain a chance of a hospitable planet.

It was pretty cool! It got people in finance thinking about climate change in a way they never had before.

It did this in two ways:

First, it focused exclusively on financial risks. There was nothing normative in the framing of the report; it was simply about potential financial losses that would arise if the world limits warming to 2C.

Second, it is a quantitative analysis, comparing oil and coal reserves against the 2C carbon budget, and then analysing the aggregate fossil fuel reserves represented in the stock exchanges of various countries. It kicked off a wave of quantitative analyses of carbon budget risks, such as comparing the oil and coal budget to supply cost curves, and conducting asset-level analysis to more precisely identify individual companies' carbon risks. This has in turn led to like the "alignment" of companies with certain warming scenarios, as used by MSCI.

I believe that this is what has confused everyone royally about ESG. The idea of "carbon risk" or "transition risk" is both normative and positive, and it is very well-suited to quantitative analysis.

So I would say that climate risk analysis was good for ESG, but it's also led to a backlash.

The more interesting question now is, has climate risk analysis been good for tackling climate change?