So much has changed and yet nothing has

I was struck by this line in a recent Quartz story back in February:

QZ: CEO Jane Fraser, in her note announcing the new 2030 climate targets, said that exiting client relationships would be a “last resort.” What would cause that to happen? If you have clients whose future business plans don’t align with that IEA scenario, at what point would you end that relationship? This week, for example, Exxon [to which Citi lent $7.5 billion in 2020] said it plans to increase its spending on oil and gas drilling by 45% in 2022, up to $24 billion.

It's from a Q&A with Citi's chief sustainability officer, Valerie Smith, by Tim McDonnell. McDonnell IS a climate reporter, true, and Quartz is a quality news publisher – but even so, the level of detail in that question is kind of mind-blowing to anyone who's worked in this space for a while. "Aligning" with an IEA scenario is some serious jargon and the kind of thing that was extremely obscure just 2-3 years ago.

A lot of my work in the past seven years has been at the intersection of climate change and finance - specifically, private* finance. A lot of this, in turn, was just basic information, such as "this is what the carbon budget is!" and "this is what to look for in decarbonisation scenarios!" but the other part was explaining why it was meaningful for financial regulators, banks and insurers?

That second category was more challenging; conveying information is not too hard, but identifying the salience for finance of information that's seen as either environmentalism or arcane science stuff is much more difficult.

One early example was the way that the IEA's long-term "climate action" scenario (the 450 Scenario, later called the Sustainable Development Scenario) didn't actually match up with the true "climate safe" carbon budget that peer reviewed, IPCC-synthesized science had identified. It didn't necessarily limit warming to 2C, let alone to below 2C, let alone to the 1.5C target that was adopted in late 2015.

Explaining why it didn't align was one thing, but explaining why that mattered was another. The sceptical responses would fall into two categories: those in or close to the modelling community, who said "it's just a scenario!", and those thought it was so self-evident that the IEA would produce a weak decarbonisation pathway that what was even the point of trying to make it better because the IEA is kinda all about oil anyway?

In the end everyone did come to the party: scenario users, energy journalists, and even the IEA itself - not perfectly but pretty well.

But even four years ago, getting anyone to care about it enough to understand it was very, very tough. Once you decide it's important, understanding the rest is not that hard.

So it's a little dizzying to see journalists in fairly general news publications writing in some detail about the merits of alignment with different long-term energy transition scenarios, when this was a concept that had no traction such a short time ago.

People who work in and adjacent to finance and investment, including policy, are increasingly seeking answers to very informed questions, when just a few years ago they didn't even think there was a question to ask.

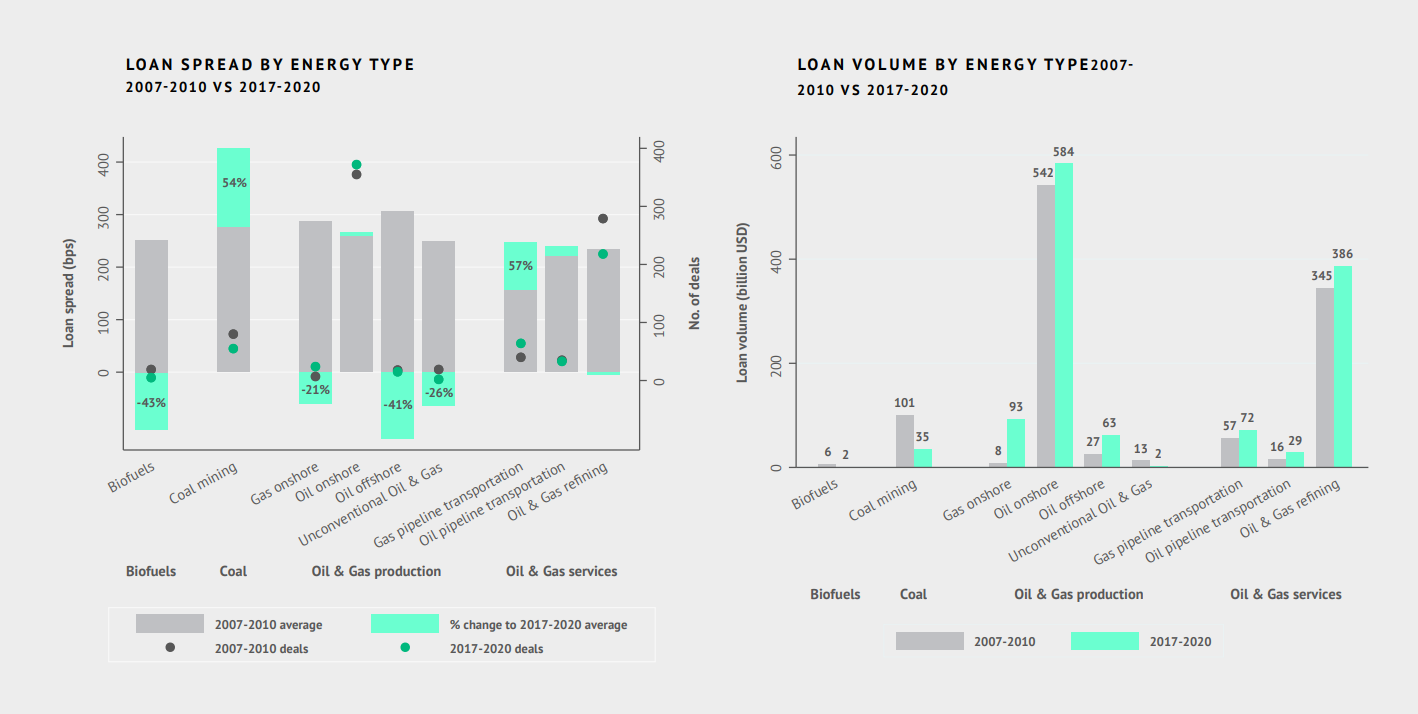

Yet, what has changed? There are many, many more roles in the financial sector that have ESG or climate in the title. The cost of capital for fossil fuels has risen a bit - that seems to be borne out now by a few studies: Goldman Sachs says offshore oil weighted average cost of capital has staggered upwards from about 10% a decade ago to about 20%, while the WACC for renewables has gently trended down 9%-ish to 4 or 5%. I don't have the full details of that Goldman analysis, however research from Oxford University that looks only at debt found that coal financing costs have risen steeply, onshore oil financing costs are stable and offshore has actually declined.

The deal volumes analysed in the categories with the most movement are quite small, and I haven't seen much evidence to suggest that fossil fuel capacity pipeline has been seriously arrested.

So mainstream finance can talk about climate scenarios with increasing sophistication - something that should lead to a curtailing of investment in fossil fuel infrastructure, but so far has not. Perhaps there is a lag. Perhaps - and this is a popular view - the ESG/climate finance crowd is just that, and other finance is still backing fossil fuels like there's no tomorrow (private equity is a favourite culprit, but banks are an obvious contender according to one of the best NGO data sources: RAN's annual analysis of big banks' fossil fuel support).

Or perhaps this is just the finance version of what Akshat Rathi called "climate whiplash" last year. Things are getting better, against an unknowable counterfactual scenario where emissions keep rising, faster. They're just not getting good enough, fast enough.

*In climate diplomacy circles, "finance" is often taken to mean official finance from development finance institutions, or the $100 billion in annual tranfers promised to developing countries in 2009/10.